Resources

-

Tax

TaxNavigating the Tax Complexity of Secondary Stock Sales

Read More -

Assurance and Advisory

Assurance and AdvisoryPart 3: Preparing for the New Software Capitalization Standard: What Finance Leaders Should Do Now

Read More -

Assurance and Advisory

Assurance and AdvisoryPart 2: How to Evaluate and Document Software Capitalization Under the New Model

Read More -

Assurance and Advisory

Assurance and AdvisoryPart 1: New Rules for Capitalizing Software Costs: What ASU 2025-06 Means for Your Business

Read More -

Life Sciences

Life SciencesHow Agentic AI in Clinical Trials Is Transforming the Experience for the Better

Read More -

Artificial Intelligence

Artificial IntelligenceGPT-5 Is Redefining AI-Driven Business Intelligence

Read More -

Driving Innovation and Purpose: Baker Tilly Honored on TIME’s World’s Best Companies of 2025

Read More -

Artificial Intelligence

Artificial IntelligenceHow AI Startups Achieve Profitability in a Competitive Industry

Read More -

Awards & Recognition

Awards & RecognitionFrank, Rimerman Named One of Inside Public Accounting’s “Best of the Best” CPA Firms for 2025

Read More -

Artificial Intelligence

Artificial IntelligenceThe Future of AI in Business Is Now and It’s Redefining Growth Across Every Sector

Read More -

Tax

TaxMaximizing Qualified Small Business Stock (QSBS) Tax Benefits

Read More -

Artificial Intelligence

Artificial IntelligenceMastering AI Startup Funding Strategies in 2025

Read More -

Risk Advisory & Assurance

Risk Advisory & AssuranceFrank, Rimerman Achieves STAR Certified Auditor Status, Enhancing Cloud Security Assurance Services

Read More -

Artificial Intelligence

Artificial IntelligenceEmerging AI Companies to Watch in the Public Market

Read More -

Artificial Intelligence

Artificial IntelligenceAI Adoption by Industry: Uncovering Transformative Impacts

Read More -

Artificial Intelligence

Artificial IntelligenceKey Financial Considerations in AI Mergers and Acquisitions

Read More -

Awards & Recognition

Awards & RecognitionFrank, Rimerman Wins Best Places to Work Award for Tenth Year in a Row

Read More -

Life Sciences

Life Sciences4 Strategies for Life Sciences Startups to Secure Early-Stage Funding

Read More -

Accounting and CFO Advisory Services

Accounting and CFO Advisory ServicesThe Common Financial Pitfalls for Startups Part 3 – Navigating Compliance: Safeguarding Startup Ventures

Read More -

Accounting and CFO Advisory Services

Accounting and CFO Advisory ServicesThe Common Financial Pitfalls for Startups Part 2 – Building Financial Foundations: A Blueprint for Startup Success

Read More -

Accounting and CFO Advisory Services

Accounting and CFO Advisory ServicesThe Common Financial Pitfalls for Startups Part 1 – Mastering Cash Management: The Key to Startup Success

Read More -

Accounting and CFO Advisory Services

Accounting and CFO Advisory ServicesThe Common Financial Pitfalls for Startups Part 4 – Mastering Equity Management: Ensuring Fairness and Stability

Read More -

Accounting and CFO Advisory Services

Accounting and CFO Advisory ServicesThe Common Financial Pitfalls for Startups Part 5 – Maximizing Savings: Strategies for Financial Efficiency

Read More -

Life Sciences

Life SciencesFrom the Lab to Accounting – Expertise is Key

Read More -

Life Sciences

Life SciencesWaiting Out the Market Before a Life Sciences IPO

Read More -

Tax

TaxCorporate Transparency Act — Beneficial Ownership Information Reporting Requirement

Read More -

Assurance and Advisory

Assurance and AdvisoryCECL – The New Credit Loss Standard

Read More -

Assurance and Advisory

Assurance and AdvisoryFrank, Rimerman + Co. LLP Peer Review Report 2022

Read More -

Awards & Recognition

Awards & RecognitionFrank, Rimerman + Co. Recognized As a 2023 Bay Area Best Places to Work

Read More -

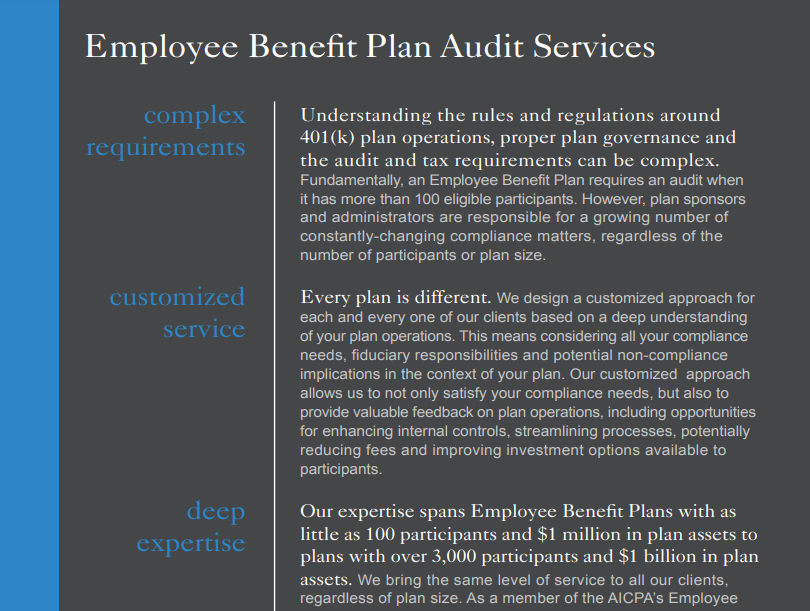

Employee Benefit Plan Audit Services Information

Read More -

Assurance and Advisory

Assurance and AdvisoryMandatory Capitalization of Research and Experimental Costs for Income Tax Reporting Purposes

Read More -

Financial Services

Financial ServicesThe New Lease Standard

Read More -

Frank Rimerman Advisors

Frank Rimerman AdvisorsFrank, Rimerman Advisors Client Relationship Summary

Read More -

Frank Rimerman Advisors

Frank Rimerman AdvisorsFrank, Rimerman Advisors Disclosure Brochure

Read More -

Assurance and Advisory

Assurance and AdvisoryThe New Revenue Standard and What Your Business Needs to Do

Read More -

Assurance and Advisory

Assurance and AdvisoryASC 606 and the Software Industry

Read More -

Awards & Recognition

Awards & RecognitionArcstone Joins Frank, Rimerman + Co. LLP

Read More -

Assurance and Advisory

Assurance and AdvisoryGoing Concern: FASB Issues New Standard on Reporting Adverse Conditions and Events

Read More -

Assurance and Advisory

Assurance and AdvisoryFASB Issues New Standards to Simplify Private Company Accounting for Goodwill

Read More -

Assurance and Advisory

Assurance and AdvisoryFASB Issues New Standards to Simplify Private Company Accounting for Certain Interest Rate Swaps

Read More -

Tax

TaxCalifornia Taxpayers lose Past and Present Rights to Certain “QSBS”-Based Benefits

Read More -

Tax

Tax2012 Year-End Tax Planning

Read More -

Tax

TaxScheduled Medicare Tax Increase for 2013 Forward

Read More -

Assurance and Advisory

Assurance and AdvisoryNew Regulations Require Quick Action by ERISA Service Providers

Read More -

Risk Management

Risk ManagementThe New JOBS Act: Key Features

Read More -

Tax

TaxNew IRS Requirements for Electronic Distribution of K-1s

Read More -

Tax

TaxPotential Changes to Regulations Governing California Enterprise Zone Credits

Read More -

Tax

TaxHighlights of the American Taxpayer Relief Act of 2012

Read More -

Tax

TaxAdditional Reporting for Foreign Financial Assets Begins with 2011 Returns

Read More -

Tax

Tax2012 Voluntary Disclosure Program for Offshore Assets

Read More -

Tax

TaxRequired Annual Minimum Distribution Planning for Private Foundations

Read More -

Tax

Tax2011 Year-End Tax Planning

Read More -

Year-End Tax Updates for Businesses

Read More -

Tax

TaxExtension for Voluntary Disclosures and Certain FBAR Filers

Read More -

Tax

TaxYear-End Planning: Private Foundations

Read More -

Tax

TaxGift Tax Exemption Update

Read More -

Tax

TaxIRS’s Voluntary Classification Settlement Program: Correcting Worker Misclassification

Read More -

Accounting and CFO Advisory Services

Accounting and CFO Advisory ServicesRepeal of Expanded 1099 Requirements

Read More -

Tax

Tax2011 New Voluntary Disclosure Program for Offshore Assets

Read More -

Assurance and Advisory

Assurance and AdvisoryChange in Reporting for Participant Loans

Read More -

Tax

TaxExercise of Incentive Stock Options: New Reporting Requirements

Read More -

Tax

TaxRecent Tax Breaks for Individuals, Estates and Businesses

Read More -

Real Estate

Real EstateLandlords Must File 1099s for Service Providers

Read More -

Accounting and CFO Advisory Services

Accounting and CFO Advisory Services1099 and W-2 Reporting: Changes Under the Affordable Care Act of 2010

Read More -

Accounting and CFO Advisory Services

Accounting and CFO Advisory ServicesHealth Benefit Renewals: Consider Health Care Reform Rules When Renewing Coverage

Read More -

Tax

TaxWinners and Losses: Profitable Businesses Face Greater Tax Liability in California

Read More -

Tax

TaxNew Schedule UTP (Uncertain Tax Position) Reporting Requirements

Read More -

Tax

TaxTax Relief for Businesses

Read More -

Assurance and Advisory

Assurance and AdvisoryReminder: Amendments to Investment Adviser Custody Rule

Read More -

Risk Management

Risk ManagementSAS 70 Reports: New Standards Will Bring Changes

Read More -

Assurance and Advisory

Assurance and AdvisoryDodd-Frank Wall Street Reform Act: Affect on “Accredited Investor” Requirements and Seed Financing

Read More -

Risk Management

Risk ManagementSelling Your Company or Raising Capital: Preparing for Capitalization Review

Read More -

Tax

TaxFamily Offices May Be Subject to More Regulation

Read More -

Tax

TaxNew Bill Requires Certain S Corporation Shareholders to Pay Self-Employment Tax

Read More -

Tax

TaxNew Bill Threatens Short-Term Grantor Retained Annuity Trusts (GRATs)

Read More -

Tax

TaxChanges to Carried Interest Taxation

Read More -

Tax

TaxLatest Developments on Estate and Gift Tax Legislation

Read More -

Transaction Readiness

Transaction ReadinessSelling Your Company or Raising Capital: Intellectual Property Considerations

Read More -

Assurance and Advisory

Assurance and AdvisoryThe New Form 5500 Online Filing Requirements: What Plan Sponsors Need to Know

Read More -

Tax

TaxFederal Qualifying Therapeutic Discovery Project Credit

Read More -

Assurance and Advisory

Assurance and AdvisoryDOL Issues Final Safe Harbor Rules for Employee Benefit Plan Contributions

Read More -

Transaction Readiness

Transaction ReadinessSelling your Company? Be Prepared

Read More -

Risk Advisory & Assurance

Risk Advisory & AssuranceStrong Controls are a Competitive Edge

Read More -

Assurance and Advisory

Assurance and AdvisoryIRS Begins Sending 401(k) Tax Compliance Questionnaires

Read More -

Risk Advisory & Assurance

Risk Advisory & AssurancePrivacy and Data Security a Concern for All

Read More -

Tax

TaxU.S. Health Care Reform Taxation

Read More -

Assurance and Advisory

Assurance and AdvisoryUnraveling the New Revenue Recognition Rules

Read More -

Assurance and Advisory

Assurance and AdvisoryShould Your Company Defer an Audit?

Read More -

Real Estate

Real EstateNew Tax Rules for Modifying Commercial Loans

Read More -

Tax

TaxIRS Extends Relief for Late “Check-The-Box” Elections

Read More -

Tax

TaxForm 90-22.1 Report of Foreign Bank and Financial Accounts

Read More -

Risk Advisory & Assurance

Risk Advisory & AssuranceAchieving Objectives Through Internal Audit

Read More -

Risk Advisory & Assurance

Risk Advisory & AssuranceManaging Sarbanes-Oxley Costs Effective control design lowers costs and increases efficiency.

Read More -

Risk Advisory & Assurance

Risk Advisory & AssuranceSarbanes-Oxley: Creating a Successful Compliance Program

Read More -

Tax

TaxUpdate: Form 90-22.1 Report of Foreign Bank Accounts (FBAR)

Read More -

Tax

TaxForm 90-22.1 Report of Foreign Bank and Financial Accounts (FBAR)

Read More -

Tax

TaxUpdate: Form 90-22.1 Report of Foreign Bank and Financial Accounts

Read More -

Tax

Tax2009 Stimulus and Tax Plans

Read More -

Real Estate

Real EstateReal Estate from a Tax Perspective

Read More

Load More